Co-founders Pierre-Yves Pirlot and Quentin Sizaire (Image Credits: Ecco Nova)

Ecco Nova is a Belgian crowdfunding platform that focuses on sustainable projects. With 10,000 members, and having already more than €23 million invested by citizens, the future looks positive for the crowdlending company.

Added to this is the launch of Ecco Nova Finance, the company’s new financing vehicle for sustainable projects, including real estate. I met with Co-founder Pierre-Yves Pirlot to discuss the company’s history & ideas.

In brief: Ecco Nova, the crowdlending platform dedicated to the ecological transition to finance your eco-responsible project

Ecco Nova is a crowdlending platform that aims to facilitate the financing of the ecological transition. Any company or project that participates in this transition is likely to be campaigned on Ecco Nova to raise a minimum of €100,000 to a maximum of €5,000,000. Ecco Nova supports renewable energy or sustainable projects, including high-energy construction.

And the company just recently added a new string to its bow : Ecco Nova Finance – a tool that reduces financial interlocutors to one, replacing the bank up to 5 millions, so that entrepreneurs can focus on developing their projects.

What’s the story behind Ecco Nova ?

Ecco Nova is the brainchild of two Belgian friends, Quentin Sizaire and Pierre-Yves Pirlot. Both are former engineering students. After university, they worked for a while in the renewable energy sector, which gave them a better understanding of the problems that many projects were facing in Belgium.

“We were both frustrated that many projects could not be realized due to a lack of funding from the private sector or opposition from citizens”, Pierre-Yves Pirlot explained.

So they decided to launch Ecco Nova, a crowdlending platform designed to help innovative and sustainable projects see the light of day. Their objective – to engage private investors and encourage citizens to invest in local and responsible projects.

“We want to show the public that crowdfunding isn’t complicated”, Pirlot said. We take care of all administrative procedures, and all risks are clearly explained on our website.

It’s also important to note that until recently, Ecco Nova wasn’t meant to replace banks, but rather to supplement their loans. Thus, if a bank lends 60% of the amount needed for a project, Ecco Nova offers to help out part of the remaining 40% in the form of quasi-equity. For the project developer, this mezzanine financing increases the leverage and free up some equity that can be invested for other developments.

In addition, they recently launched Ecco Nova Finance, their financing vehicle.

Its role is to grant loans to project leaders by financing themselves from investors who determine the project leader they wish to finance. Each loan is housed in a separate compartment in the assets of Ecco Nova Finance. Via this mechanism, they can replace the bank up to 5 million euros. Ecco Nova Finance then takes security with the project leader and passes it on to the investors.

As banks are increasingly reluctant to lend, this is certainly an advantage. By putting decision-making in the hands of a diverse investor community, more sustainable projects will have the opportunity to flourish.

In addition, the platform allows the dormant hundreds of millions in Belgian savings accounts to be invested in tangible projects that benefit the economy while being part of an ecological citizen approach.

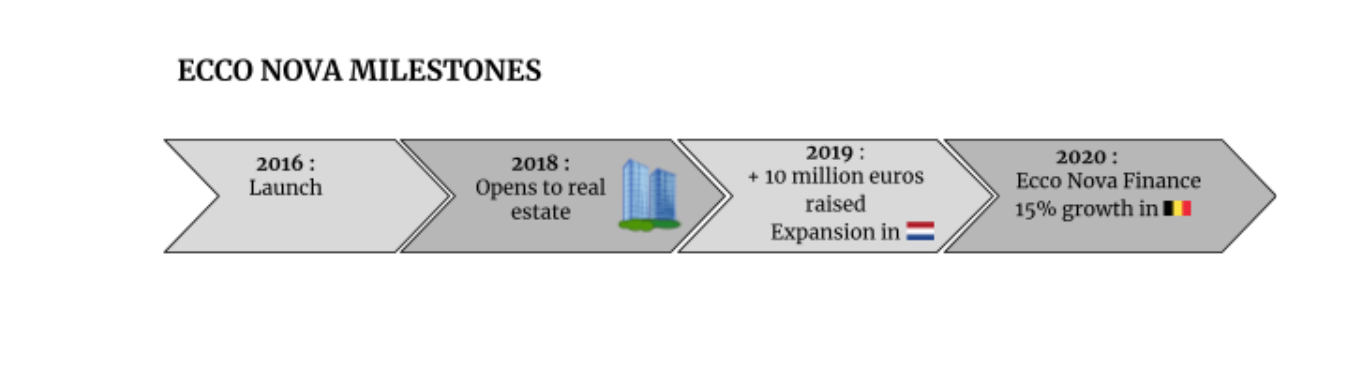

Ecco Nova in a few dates

- Ecco Nova was publicly launched in 2016 and has since helped finance various innovative projects.

- In 2018, the company extended its offer to the real estate sector, contributing to sustainable investments in housing.

- In 2019, the amount raised via Ecco Nova exceeded €10 million. They also expanded to the Netherlands, where they are now also licensed.

- In 2020, despite the pandemic, they launched Ecco Nova Finance and grew by 15% in Belgium alone – mainly thanks to real estate, but also because access to banking investments was reduced.

How does it work in practice?

For project developers: all you have to do is go to their website and fill out the form with your information. There you will also find out about the eligibility requirements.

Once you’ve completed the form, they’ll get back to you quickly with a pre-analysis.

Then Ecco Nova will do due diligence on your project, performing detailed analysis before making you a final offer. This entire process takes between 2 and 4 weeks. Then, when you have signed their offer and everything is in order, your project is published on the website for investors to see and the campaign begins.

The crowdlending part is usually pretty quick – and all of Ecco Nova’s fundraisers have been successful so far.

Click here to find out more about the process.

Ecco Nova’s fees :

“Our prices include a success fee”, Pierre-Yves Pirlot explained, “and also depends on the mass of marketing necessary – because we also offer, as an option, to carry out information sessions, to sensitize various audiences to the project, to conduct a campaign in targeted areas of investors (regional, citizens, etc.). So depending on the amount of marketing desired by the entrepreneur, our prices can change”.

Ecco Nova thus uses all the tools needed to ensure that your project is adequately promoted to target groups and subsequently developed.

Ecco Nova’s current and future plans :

Since its beginnings, Ecco Nova has been governed by two main axes that determine its present and future actions, Pirlot said. The company aims to :

- Accelerate the ecological transition.

- Activate as many dormant savings in tangible and sustainable projects. There are currently over 250 billion euros in dormant accounts in Belgium.

In addition, Ecco Nova is already committed to supporting SMEs that share their ecological interests. In the future, they want to continue this momentum.

“Ecco Nova wants to bolster financing for small and medium-sized enterprises (SMEs) with a green focus”.

Finally, the company’s services also include the financing of your projects (between € 100,000 and € 250.000 or € 300,000 – depending on the region) via regional regulatory frameworks. If your SME is eligible, these loans will allow you to finance your project at an attractive rate (maximum 1,75%) without the need to provide collateral.

Some examples of projects funded via Ecco Nova

- The Horizon Saive project. Led by the Liège-based group Horizon, the project consists of the construction of an eco-district in Saive, a village on the outskirts of Liège. The neighborhood will consist of 27 houses and construction will start in spring 2021.

‘The crowdlending process enabled Horizon to take its vision to the next step.”

“This is the first project we have done with Ecco Nova Finance”, explains Pirlot. “We had more than 650 investors, and we were able to raise 2,500,000 euros replacing the bank as a source of financing for this project. Our loan will allow Horizon to buy the land and build the show house”.

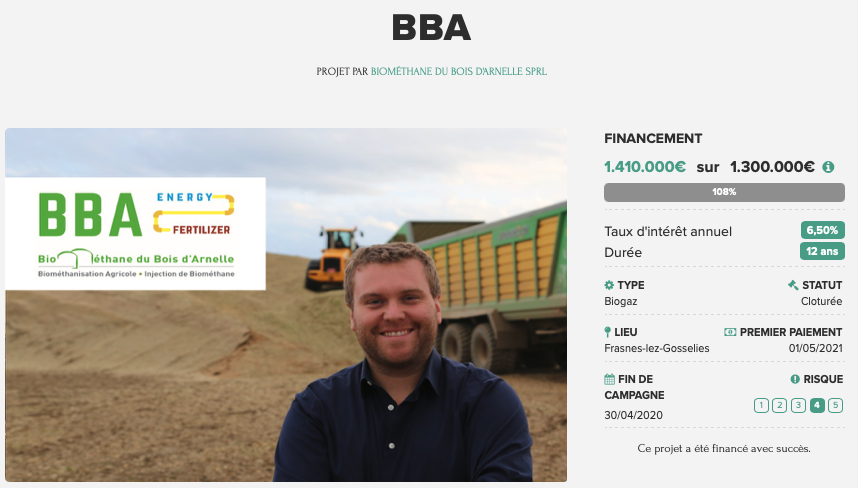

2. The BBA project : a biomethanization project with injection of biomethane into the ORES natural gas distribution network.

3. Tivoli Greencity – Ecco Nova’s emblematic campaign in the north of Brussels (at Tour & Taxis). It is a complex of about 400 housing units of high energy quality. Ecco Nova financed the heating system (€385,000).

“The whole project really got us excited”, Pirlot said, “with its green, social and innovative vision”.

This is yet another example of the green collaborative future that Ecco Nova is aiming to deliver.

Through these projects, Ecco Nova has demonstrated the efficacy of crowdlending as a platform to fund tangible and sustainable projects across a range of sectors, from eco-neighborhoods to biogas units.

Many citizens, as individuals, are keen to do their part in achieving climate targets by backing local projects.

Crowdlending through platforms such as Ecco Nova helps them concretize these plans. It’s a simple and democratic way to launch projects that are sustainable and economically viable.

Their message to our members @ProptechLab :

“If you are a company that generates a positive ecological impact, don’t hesitate to contact us via our website” invites Jean-Pierre Pirlot.

- The content of the interview has been summarized and edited for clarity.

Liuba Diederich